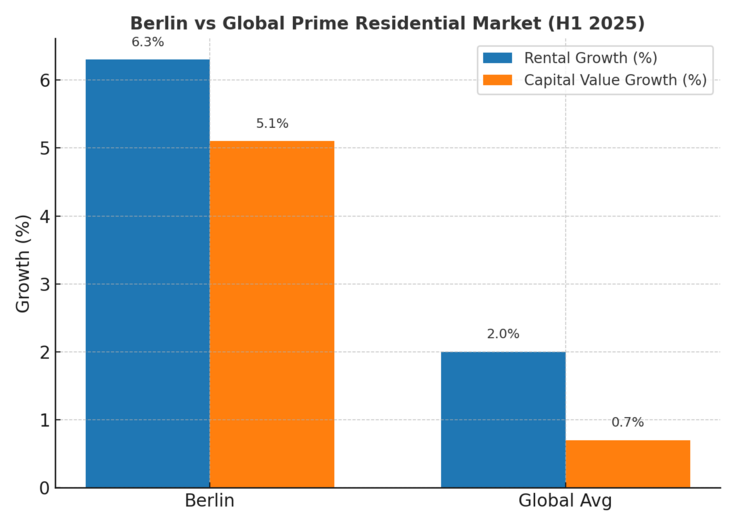

In the first half of 2025, prime residential markets worldwide showcased surprising resilience amid turbulent global conditions. Average capital value growth across 30 global cities stood at a modest 0.7%, while rents rose more robustly at 2%.

Berlin: A Standout Performer in Europe’s Rental Surge

- Rental Growth Leader in Europe: Berlin posted one of the strongest rental price increases, with rents climbing by 6.3% over the six-month period. This outpaced most global markets and positioned Berlin as a rental market outperformer in Europe.

- Capital Value Growth Above Global Average: Capital values in Berlin rose by more than 5% in H1 2025, making it one of the few cities achieving notable price appreciation. The growth is fueled by tight supply and sustained demand.

What’s Driving Berlin’s Prime Market Strength?

Constrained Development & High Demand

Berlin continues to grapple with a limited supply of prime housing, as development remains tightly regulated. This scarcity, paired with growing demand, has catalyzed both rent and price increases.

Market Dynamics Amid Uncertainty

While broader macroeconomic and geopolitical volatility has tempered global residential markets, Berlin’s prime segment has benefitted from strong fundamentals—lifestyle appeal, investor confidence, and scarcity of stock.

What Lies Ahead?

Berlin is projected to remain stable in the coming months. The first half of 2025 highlights a broader trend: during uncertain times, prime rental markets often gain more momentum than ownership. For both investors and homeowners, Berlin’s trajectory underscores the lasting appeal of high-quality, well-located real estate backed by strong rental demand.